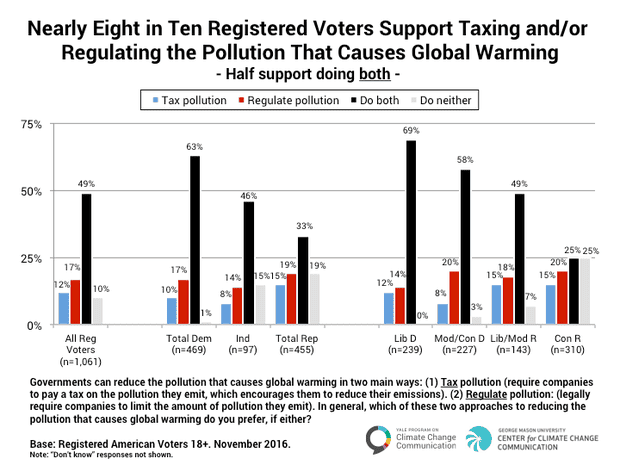

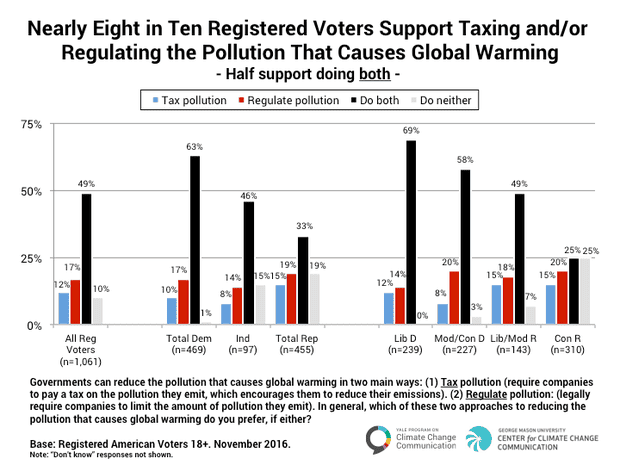

According to a new study published by Yale scientists in Environmental Research Letters, Americans are willing to pay a carbon tax that would increase their household energy bills by $15 per month, or about 15%, on average. This result is consistent with a survey from last year that also found Americans are willing to pay an average of $15 to $20 per month to combat climate change. Another recent Yale survey found that overall, 78% of registered American voters support taxing and/or regulating carbon pollution, including 67% of Republicans and 60% of conservative Republicans.

This raises the question – with such broad support across the political spectrum, why doesn’t America have a carbon tax in place by now? Study co-author Anthony Leiserowitz noted the similarity to public support for many gun control policies:

Policy elites sometimes have ideological stances quite different than their constituents, even of their own party (e.g., background checks on gun purchases in the US which is overwhelmingly favored by Democrats and Republicans).

Public support often doesn’t translate into policy. On the issue of gun control, Republican lawmakers are afraid that if they vote for even the most benign policies like requiring background checks for all gun purchases, the NRA will mobilize its supporters against them. In primary races with relatively low turnout, with partisans more likely to vote, Republican lawmakers fear that mobilizing even a relatively small minority of opposition voters could cost them their jobs. On the issue of climate change and carbon taxes, they have the same fear of the Koch network.

In short, the wealthy and powerful have more influence over American policy than average voters.

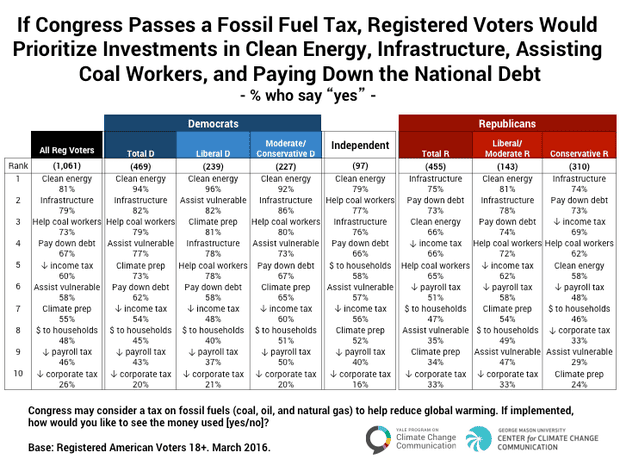

The new Yale study also asked survey participants how they would like to use the revenue generated by a carbon tax. Supporting the development of solar and wind energy and funding infrastructure improvements were the two most popular choices (around 80% support), followed by assisting displaced coal workers (73% support) and paying down the national debt (67% support). Interestingly, the option of returning the revenue back to taxpayers was supported by fewer than half of Americans – both Republicans and Democrats.

Basically, Americans support a carbon tax because they want action to address climate change, and they want to spend the revenue on clean energy for the same reason. Or they at least want to spend the money on something they consider important; for conservative Republicans, paying down the national debt was the top choice.

However, we’ve seen that public opinion doesn’t dictate policy, and there are some important reasons why returning all of the carbon tax revenue to households (a.k.a. ‘revenue neutrality’) has widespread support, including among many prominent Republicans.

Secondly, because poorer households spend a larger proportion of their income on energy bills, a carbon tax would be a regressive policy. However, because wealthier households use more energy and thus have larger net energy bills, returning all the revenue equally to households would be a progressive policy. Studies have found that most households would actually come out ahead, with rebate checks exceeding their increased energy costs, and particularly lower income households. Studies have also shown a revenue-neutral carbon tax policy would grow the economy, largely for this very reason – the rebate checks would give people more disposable income to spend.

Third, returning the revenue to households would allow for a higher carbon pollution tax. If Americans are willing to pay an extra $15 per month to tackle climate change, that would translate to a very modest carbon tax. But if some or all of the revenue is returned to households, net energy costs will be offset by rebate checks, allowing for a higher carbon tax at the same cost to households. And the higher the tax, the more effective it will be at reducing American carbon pollution.

Posted by dana1981 on Monday, 23 October, 2017

|

The Skeptical Science website by Skeptical Science is licensed under a Creative Commons Attribution 3.0 Unported License. |