Renewables allow us to pay less, not twice

Posted on 9 April 2025 by Guest Author

This is a re-post from The Electrotech Revolution by Daan Walter

Last week, UK Conservative Party leader Kemi Badenoch took the stage to advocate for slowing the rollout of renewables, arguing that they ultimately lead to higher costs:

“Huge amounts are being spent on switching round how we distribute electricity because we must effectively build two systems of electricity generation – one based on renewables and one not. One for when the sun shines and the wind blows. And one for when they don’t.” [i]

At first glance, this argument seems intuitive—and therefore persuasive: if we need to build two separate power generation systems, it must be more expensive. But this logic is fundamentally flawed. It conflates upfront capital expenditure with total system costs, focusing narrowly on installation expenses while ignoring the costs of purchasing fuel to run fossil power plants. This is a common misunderstanding in the energy transition debate today—we call it the "double cost fallacy.” It's time we move past it.

To illustrate where this line of thinking goes wrong, let’s examine a simple, stylized example. Imagine we get granted a large plot of land and 1 GW grid connection that we need to supply with power all 8,760 hours per year, for 25 years. Our task is to find a cheap, reliable way to do this. We’ll set our scene in the south of the UK, exclude local carbon taxes to focus purely on economics, and use some standard cost assumptions for power generation technology, largely from the UK's DESNZ (detailed assumptions at the bottom of the article).[ii]

As we'll see, we can supply 70% of this power with solar energy without any additional cost compared to just operating a gas plant. Interestingly—and perhaps counterintuitively—the total cost of running a 1 GW gas plant continuously is actually higher than building a combined system of 1 GW gas, 6.5 GW solar, and 12 GWh of battery storage.

We will build out this case in this article—but if you want to jump ahead and play around with this hypothetical setup yourself, you can do so with this simple webtool.

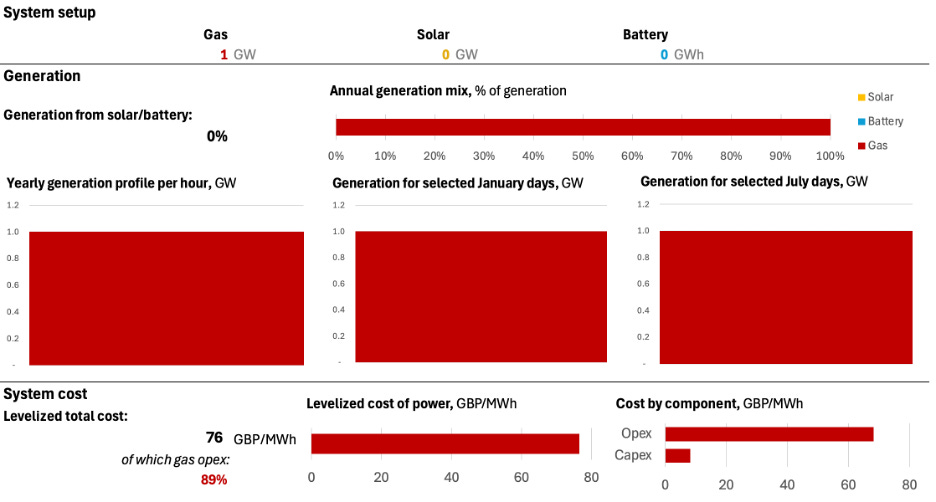

The gas case

Let’s start with a baseline. We can consider just building a 1 GW gas power plant to deliver our 1 GW baseload. You’ll get the very boring result below: 100% gas generation all year round. This solution has a total cost of approximately £76/MWh. Remember that number as we’ll refer to this later as benchmark.

Source: DESNZ; NREL; Renewables.ninja; author’s analysis

Note that only £8/MWh is for paying off the capex, and the other £68/MWh goes into running costs — predominantly the cost of buying gas. The latter we will try to reduce by adding in renewables now.

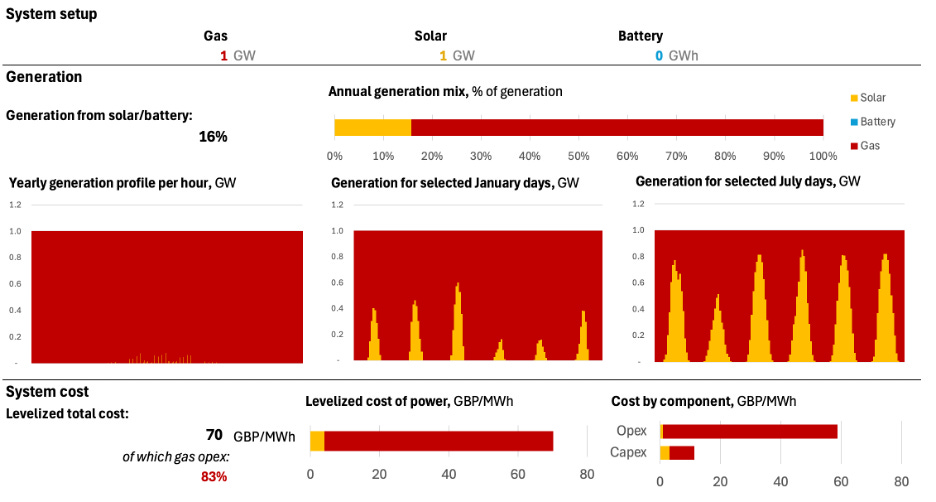

Adding solar on top

So let's add some solar energy into the mix. Suppose we install an additional 1 GW of solar capacity alongside the 1 GW gas plant. You then get the result below.

Source: DESNZ; NREL; Renewables.ninja; author’s analysis

Contrary to what the double cost fallacy implies, total system cost actually falls when we add solar on top of gas. In our example, the system costs falls to about £70/MWh. This reduction occurs because during daylight hours we can rely on free sunshine rather than expensive gas to make electricity. As a result, gas usage drops by around 16%. As one can see from the three generation charts at the bottom, summer months are of course better than winter months for solar.

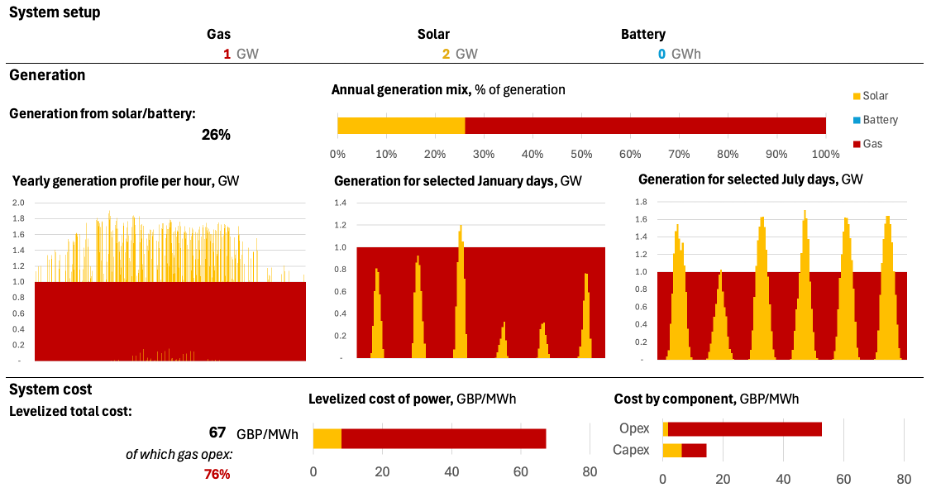

Adding more solar on top

Continuing this logic, let's double our solar capacity to 2 GW. Even if this means occasionally generating more solar power than needed, we can just throw away the excess. We get the result below.

Source: DESNZ; NREL; Renewables.ninja; author’s analysis

Remarkably, despite some solar energy being wasted during peak generation times, overall costs decline even further, saving another £3/MWh. Solar energy now accounts for over a quarter of total generation, while the total system costs £9/MWh less than just using gas.

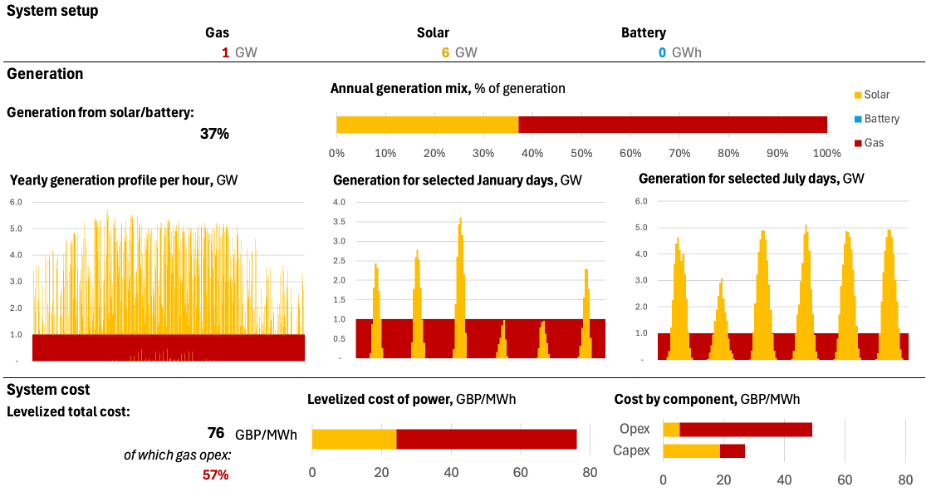

Adding even more solar on top

Taking it further, suppose we expand dramatically and install 6 GW of solar alongside our 1 GW gas plant. We then get the result below.

Source: DESNZ; NREL; Renewables.ninja; author’s analysis

In this configuration, solar generation covers nearly 40% of the total. Although the system cost rises compared to the previous 2 GW solar case, it is no more expensive than our initial gas-only scenario at £76/MWh.

Add some batteries

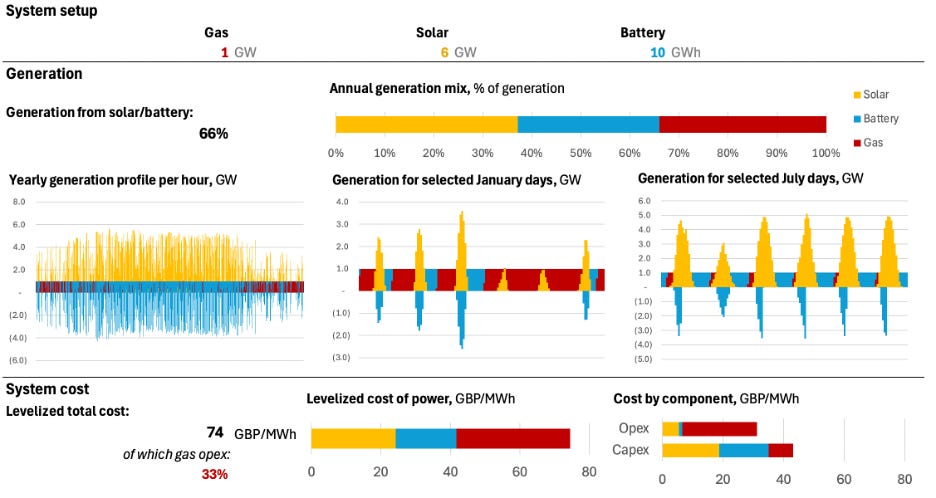

But note that we now built so much solar we’re still leaving a lot of valuable energy unused. Even many winter days now have solar overproduction. By adding battery storage we can store excess solar power generated midday for later evening and night use. Adding 10 GWh battery capacity on top gets us this result:

Source: DESNZ; NREL; Renewables.ninja; author’s analysis; Note: negative numbers for battery power means the battery is charging. Positive numbers means it is discharging.

As you can see, adding batteries reduced total cost again, down to £74/MWh. At the same time it dramatically increases the share of solar generation to 66%—some 38% directly from solar and an additional 28% supplied from solar energy stored in the daytime. We only really use gas for some cloudy or winter days when solar generation is insufficient. Note how there are two days in January where the solar peak barely meets midday demand, requiring gas backup. Conversely, summer solar peaks are very high and wide, making it possible to cover demand almost entirely from solar and batteries.

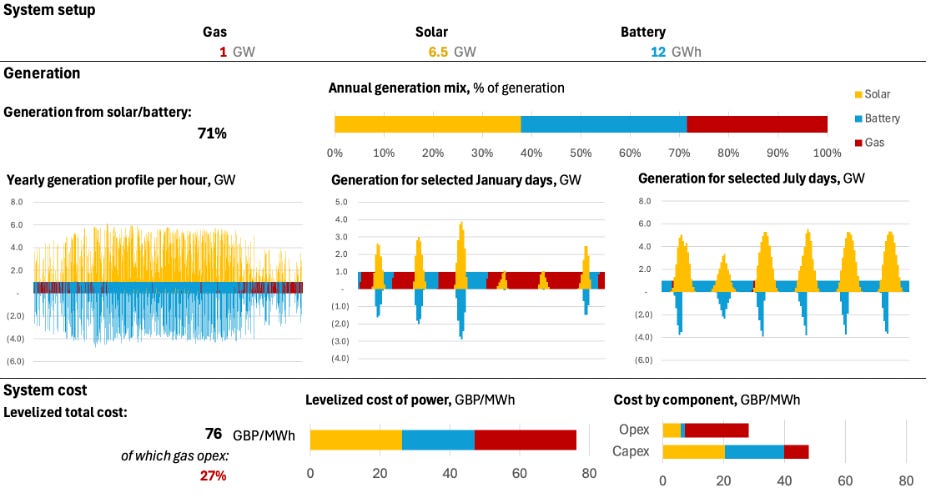

Getting as far as we can within our budget

Let's push the boundaries further and see how much solar we can get in the system without exceeding the 100% gas case’s £76/MWh. Playing with the numbers we find that installing 6.5 GW of solar and 12 GWh of battery storage alongside our 1 GW gas plant, we can get to the result below:

Source: DESNZ; NREL; Renewables.ninja; author’s analysis; Note: negative numbers for battery power means the battery is charging. Positive numbers means it is discharging.

Solar now accounts for over 70% of total generation. During the summer basically all electricity now comes from solar. This system costs the same £76/MWh as the 100% gas case. Remarkably, a combination of 1 GW of gas, 6.5 GW of solar, and 12 GWh of battery storage can achieve the same overall system cost as installing just 1 GW of gas.

This result seems counterintuitive if you just hear it out-right — but as we have now seen, it makes sense when you consider that in the latter case, we're avoiding the significant running costs associated with gas. Natural gas requires extraction, transportation—often from distant locations—and processing before it ever reaches a power plant. That costs a lot of money too.

As it turns out, avoiding those costs per GW of gas is worth 6.5 GW of solar plus 12 GWh of battery storage in the UK.

These are conservative estimates

It is good to re-iterate that all of this analysis was done for the UK, a country notorious for its lack of sunshine. Adding in cheap wind, which complements solar well (it’s often windy when it’s not sunny) would likely reduce costs even more and lead to an even larger share of generation from renewables. Then again, solar and batteries by themselves can already economically get to over 70% in rainy England. That gets us already most of the way there; which is remarkable.

Even more so considering we just looked at pure market economics in the above—before subsidies and carbon taxes. Adding in carbon taxes makes gas plants even more expensive to run. If one does include it, you can get up to about 85-90% solar generation for the same price as running the system on 100% gas.

Our business case calculation also does not take risk into account. That would make the optimal solar case even more attractive: since gas prices would only determine about 27% of your levelized cost, compared to 89% for a fully gas-based setup. The next time global gas markets go crazy—which, let’s face it, is likely to happen at least once over the 25 years of this project—, the solar plus battery setup will be much better insulated against price shocks.

Of course, our assessment also overlooks the broader economic benefits of investing in solar panels and batteries — particularly the fact that most of this investment actually goes toward construction, which primarily benefits local companies. This stands in stark contrast to paying for imported gas, where the money leaves the UK economy and is unlikely to return.

There are various other reasons to believe the real-life case for solar would look even more attractive.[iii] And would look continue to look better and better over time as solar and battery costs continue to fall. According to DESNZ projections, solar capital costs are expected to drop another ~30-40% over the next decade or two, approaching £300/kW. Meanwhile, in China, stationary storage battery tenders are already coming in below £70/kWh, and such low prices will eventually make their way to the West as well.[iv]

If we rerun our calculations using these prices, the optimized solar scenario would cost just £57/MWh—25% less than the all-gas case. To get some of that future benefit, we can of course decide to no build everything at once today. A practical approach would be to start with a few gigawatts of solar, gradually add batteries as their costs fall, and then continue expanding both as they become more and more affordable. This step-by-step transition is exactly how we are transforming the national power system today—panel by panel, battery by battery, fossil fuels are being replaced by clean, efficient renewables.

Conclusion

These calculations clearly show that the double cost argument is a fallacy. If you still have doubts, please try it out for yourself in our online model. The fallacy focuses on upfront capital costs while overlooking operational savings. This oversight masks an extraordinary development: renewables are now so incredibly cheap that their total cost (capital plus operating expenses) isn't just lower than building and running a new fossil-fuel plant—it’s even cheaper than running an existing fossil plant.

This means renewables are economically worthwhile based solely on the fuel savings they provide. Even if they would never fully replace fossil power plants, but only reduce how much fuel those plants consume, they would be worth it. Simply reducing fossil fuel use during sunny or windy periods—or when batteries charged from these periods are available—saves more money than the entire investment in renewables. That's how remarkably cheap solar, wind, and batteries have become—and precisely why they're winning around the world today.

______________________________________

Assumptions

This analysis primarily relies on cost estimates provided by the UK government (DESNZ). DESNZ estimates UK solar capital expenditure at approximately £450/kW, and gas plant capital expenditure at roughly £600–700/kW. However, these gas plant estimates are adjusted slightly upward to reflect recent examples from the US, where current gas capacity costs can reach as high as $1,500/kW (approximately £1,150/kW). To remain conservative yet realistic, the analysis assumes the purchase of a moderately priced gas plant with 45% efficiency at around £800/kW. For battery storage, a cost of £200/kWh is assumed.

Fixed operation and maintenance (O&M) costs, including insurance, are included as follows: £18,000 per MW per year for gas plants, £8,000 per MW per year for solar, and £6,000 per MW per year for batteries. Gas generation also includes a variable O&M cost of £4/MWh. Financing assumptions include a Weighted Average Cost of Capital of 7.5% for gas plants and 5% for solar and battery installations. For solar generation, a representative DC profile from southern England, sourced from Renewables.ninja, is used, with a typical inverter clipping ratio of 1.2 applied.

Currently, gas prices in the UK remain high, at approximately £35/MWh. While future price trajectories are uncertain due to the volatile nature of the commodity, it is reasonable to expect some decline over time. This analysis assumes an average gas price of £28/MWh over the project’s lifetime, reflecting an expected near-term decrease (as suggested by the futures market) and a gradual long-term convergence to the pre 2020 low levels of £21/MWh. However, another gas price spike—similar to those seen over the past three years—is quite plausible and would raise the average to over £30/MWh. At that level, additional investment in solar and batteries becomes even more attractive.

Our analysis assumes we pool all our power capacity behind the meter into one transmission cable of 1 GW. One could of course also consider doing this in a more distributed way. If we separately connect solar to the grid we can conservatively assume an additional £100/kW grid connection cost for solar. Including this doesn’t change our answer much: it would still be competitive to get to 60-65% of generation from solar power. A bit of location diversification may actually help with the solar profile and push out more gas.

If you’d like to see how the results would change under different assumptions, I encourage you to take a look at the online model.

______

Endnotes:

[i] See https://www.conservatives.com/news/watch-live-kemi-launches-the-policy-renewal-programme

[ii] See https://www.gov.uk/government/publications/electricity-generation-costs-2023

[iii] For example, this analysis used a simple battery dispatch approach—charging and discharging whenever possible—but a smarter strategy could further reduce costs. For example, optimizing discharge timing by always maintaining a 100 MW reserve could lower the required gas capacity to 0.9 GW. Additionally, setting a more efficient inverter clipping ratio and consolidating all solar panels and batteries behind a single 1 GW inverter could improve cost efficiency.

[iv] See https://www.energy-storage.news/behind-the-numbers-bnef-finds-40-year-on-year-drop-in-bess-costs/

Arguments

Arguments

So many vested interests in slowing down the transition away from fossil fuels, ( and very successful at it too! ). As the journalist Peter Milne says here..www.boilingcold.com.au/inpex-chief-executive-expects-australias-help-to-blow-the-paris-agreement/... "a nation that allows foreign governments and multinationals to determine its economic, environmental, and energy policies." Probably true for so many others too, how sad..